A New Standard for Risk, Claims, and Asset Resiliency

Capture every Detail. Mitigate Every Risk. Resolve every dispute — Faster.

Pre-Loss delivers powerful Digital Twin Solutions for Insurance, Legal, Real Estate, Education, and Public Sector stakeholders.

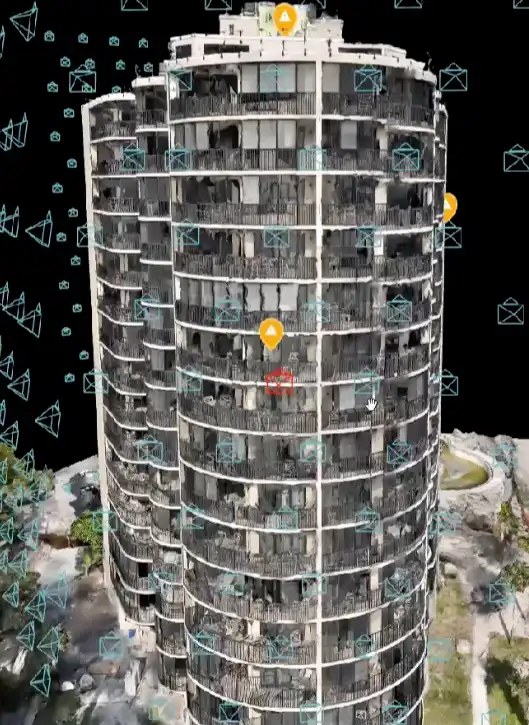

Digital Twins

Risk Management Twin

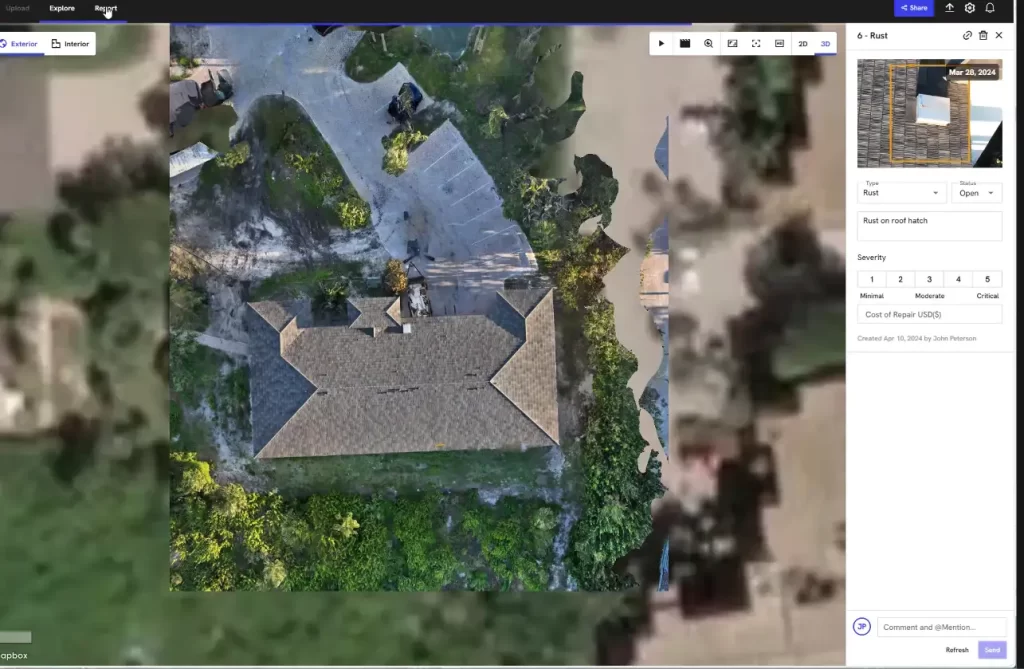

Monitor assets remotely, identify risks early, and extend asset lifespan.

Enhanced Underwriting and Risk Assessment

Legal & Dispute Resolution Twin

Settle claims faster with a fully annotated, multi-perspective digital twin.

Bring together insurers, engineers, and third-party adjusters with one source of truth.

Deliver forensic-level evidence for claim disputes, including engineering reports and thermal imaging.

Define exact scopes of repair and secure fair claim resolutions.

Public Sector & Education Twin

Increase campus safety with predictive analytics and AI-driven CCTV monitoring.

Support resiliency planning and reduce liability exposure.

Insurance - Claims & Underwriting Twin

Multi Line coverage

Support resiliency planning and reduce liability exposure

Built for Faster Recovery, Smarter Risk, and Stronger Results

Pre-loss redefines efficiency in the insurance industry by integrating cutting-edge digital twin technology and precise data analytics. This approach shortens underwriting and claims timelines while ensuring higher accuracy, ultimately leading to faster payouts and improved customer loyalty.

Reduce Loss Ratios

Prevent avoidable claims through predictive scanning and

maintenance insights.

Lower Insurance Costs

Prove risk mitigation efforts with pre-loss documentation and

active monitoring.

Faster Dispute Resolution

Move from conflicting reports to shared, interactive 3D evidence.

Enhance Asset Value

Protect investments by proactively identifying and fixing vulnerabilities

Strengthen Stakeholder Trust

Deliver transparency to insurers, owners, investors, and

communities.

Industries We Serve

How Insurance Professionals Use Pre-Loss

Digital Twin Creation

Enhanced Underwriting and Risk Assessment

Streamlined Claims Processing

Fraud Mitigation & Loss Control

Step 1:

Digital Twin Creation

Pre-Loss technology generates a digital twin of insured properties and assets, capturing detailed visual and structural data.

Purpose:

Establishes the pre-loss condition baseline for underwriting and claims purposes.

Outcome:

Provides insurers with comprehensive documentation to minimize disputes.

Step 2:

Enhanced Underwriting & Risk Assessment

Insurers leverage the digital twin to perform detailed risk assessments and validate asset conditions during underwriting.

Purpose:

Improves pricing accuracy and reduces exposure to unforeseen risks.

Outcome:

Supports more precise policy terms and minimizes underwriting errors.

Step 3:

Streamlined Claims Processing

In the event of a loss, the digital twin enables direct comparison of pre- and post-loss conditions, expediting claims validation.

Purpose:

Reduces the time and effort required to verify claims, avoiding delays and disputes.

Outcome:

Enhances customer satisfaction and lowers

administrative costs.

Step 4:

Fraud Mitigation & Loss Control

The pre-loss baseline helps insurers validate undisputed damages faster and more accurately.

Purpose:

Improves fraud detection while ensuring claims payments align with the true extent of the loss.

Outcome:

Reduces financial leakage and improves loss ratios

How Real Estate & Construction Uses Pre-Loss

Generate a baseline scan of the asset to establish current condition

Project Planning & Risk Identification

Progress Monitoring & Compliance Management

Claims Support & Maintenance Planning

Step 1:

Baseline Scan

Pre-Loss technology captures a property’s condition by creating a digital twin with detailed visual and structural data.

Purpose:

Establishes a comprehensive baseline for ongoing monitoring and documentation.

Outcome:

Ensures all stakeholders have access to a precise, up-to-date record of the asset.

Step 2:

Project Planning & Risk Identification

Real Estate & Construction teams use the digital twin to plan construction or renovation projects, identifying potential challenges and risks.

Purpose:

Improves project accuracy and reduces unexpected delays or cost overruns.

Outcome:

Enables more efficient and effective resource allocation and enhances collaboration between project teams.

Step 3:

Progress Monitoring & Compliance Management

The digital twin can be used to provide updates to track construction progress and ensure compliance with regulations

Purpose:

Helps identify discrepancies and proactively address them to avoid compliance issues.

Outcome:

Keeps projects on schedule and ensures adherence to building codes and safety standards.

Step 4:

Claims Support & Maintenance Planning

After construction or in the event of damage, the digital twin enables before-and-after comparisons to validate claims or assess repair needs.

Purpose:

Simplifies claims processing and provides accurate data for future maintenance planning.

Outcome:

Streamlines insurance claims and reduces the long-term cost of asset management.

How Safety & Compliance Professionals Use Pre-Loss

Asset Scanning and Digital Twin Creation

Compliance Analysis, Hazard Identification, Risk Assessment

Proactive Maintenance and Corrective Actions

Post-Event Assessment and Reporting

Step 1:

Asset Scanning and Digital Twin Creation

Pre-Loss technology generates a digital twin of the asset using advanced scanning methods to capture its current condition and compliance status.

Purpose:

Provides a precise, visual baseline for regulatory and safety inspections.

Outcome:

Ensures an accurate record for audits and assessments.

Step 2:

Compliance Analysis, Hazard Identification

The data from the digital twin is analyzed to identify potential compliance gaps or safety hazards.

Purpose:

Helps professionals prioritize areas requiring attention to meet regulatory standards and improve workplace safety.

Outcome:

Reduces the likelihood of non-compliance fines and workplace incidents.

Step 3:

Proactive Maintenance and Corrective Actions

Leveraging insights from the digital twin, professionals can schedule proactive maintenance and implement corrective measures.

Purpose:

Prevents issues before they escalate into costly repairs or safety risks.

Outcome:

Ensures assets meet safety regulations and function optimally.

Step 4:

Post-Event Assessment and Reporting

In the case of a safety incident or inspection, the digital twin enables a clear before and after comparison, ensuring transparent reporting

Purpose:

Facilitates accurate incident analysis and streamlines regulatory reporting processes.

Outcome:

Demonstrates due diligence and enhances trust with stakeholders and regulators.

Welcome to Pre-Loss, the home of Inspection Solutions, the Asset Rosetta Stone for commercial and high net worth owned structures. In the world of high TIV assets, our bespoke solutions address the challenges and pain points faced by all asset stakeholders – adjusters, producers, contractors, attorneys, etc. This is done by providing structured data that establishes a clear baseline, reducing underwriting time, reducing loss ratios, and improving the accuracy and speed of indemnity payments. Empower your team with the intelligence needed for strategic decision-making and experience a new standard in insurance efficiency with Pre-Loss.

Key Benefits of Our Advanced Solutions

Pre-loss redefines efficiency in the insurance industry by integrating cutting-edge digital twin technology and precise data analytics. This approach shortens underwriting and claims timelines while ensuring higher accuracy, ultimately leading to faster payouts and improved customer loyalty.

Custom Underwriting Solutions

Loss Benchmarking and Reduction

Provide benchmarks that help improve loss ratios.

Cost-Effective Loss Adjustment

Loss Adjustment Expense improvement with structured data baseline to measure against

Loss Control Risk Management Solutions

Reduction of ambiguity through structured data and our baseline analysis features, leads to improved loss ratios, lower claims frequency, lower claim severity, and customer service scores

Comprehensive Underwriting Support

Baseline intelligent twin

What are the personas

Inspectors:

Allows Building Officials and other inspectors to access digitized virtual models, improving efficiency and compliance accuracy

Claims Adjusters:

Quickly verify claims with

real-time information.

Risk Managers:

Get insights to reduce risks

and improve safety.

Contractor

Use detailed data for easier

inspections.

Underwriters:

Make risk assessment faster

and more accurate.

Inspectors:

Use detailed data for easier

inspections.

Contractor

Detailed structured data and 4D model increase productivity and accuracy by 30-40%.

Claims Adjusters:

Increased validation and improved claims cycle time, improving net promoter scores

Risk Managers:

Granular insights to reduce risks and improve safety | Predict & Prevent | Lower claim frequency and severity | Resilience Ready Risks

Underwriters:

Make risk assessment faster

and more accurate.